8 REASONS WHY YOU CAN OUTPERFORM YOUR FUND MANAGER.

The top-performing funds in Australia’s Superannuation pension system returns 9% per year, according to StockSpot. These funds have billions of dollars under management, a team of PhD’s and MIT computer scientists at their disposal, and access to better data and more powerful computer equipment worth millions of dollars. So, what are the chances that regular independent traders outperform them?

Quite high, it turns out.

These are the top performing strategies In DARA app

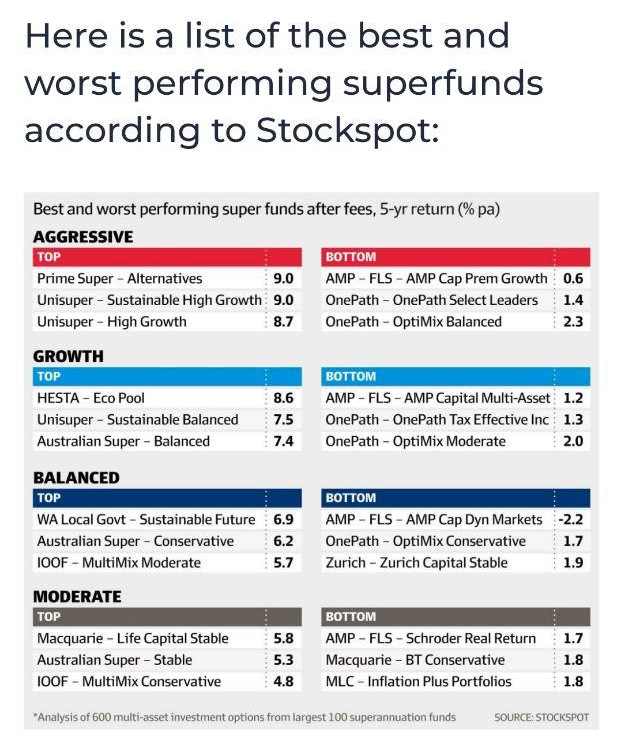

These are best and worst performing Australian superannuation funds

“No one cares more about your money that you do. With basic understanding of the investment process and a bit of discipline, you’re perfectly capable of managing your own money … By Managing your own money, you’ll be able to earn higher returns and save many thousands in investment costs over your lifetime.

”— Alexander Green, The Gone Fishin’ Portfolio

Here are 8 reasons why you can outperform even the most stellar fund managers:

These funds are designed to not rock your boat. They have to keep a lot of people comfortably within their volatility thresholds. Even the most aggressive fund strategies are just plain vanilla investments in major Equities, Government and Corporate bonds, and cannot take advantage of riskier alternative assets such as Forex, Commodities, unlisted or individual stocks and Cryptocurrencies.

Index – Their benchmark is to match the stock index performance (Single figure returns). These funds are assessed against the performance of their benchmark stock market index. If they are charging all those fees and can’t match the stock market, they will lose a lot of customers very quickly. The fund managers will even congratulate each other and consider a year successful (and pay big bonuses) when the fund has lost their customers’ money if the stock market has lost even more.

Regulation – They have to stick to regulatory requirements. There is huge red tape on which assets regulated funds can invest in. Most of the time funds are only allowed a few asset classes that they specialise in. If this asset class is underperforming they cannot jump ship and invest in something else. But as an independent trader you can invest in anything – uranium miners or cannabis plantations, if you wish.

Long only. Most funds are only allowed to BUY (go Long) an asset class. But they can’t always Short the market (borrow assets, sell them, and repurchase them at a lower future price) even if they see money-making opportunities. As an independent trader you can go Long and Short – and take advantage of any market crashes by shorting the market.

Cash. Some funds are not allowed to keep cash. This means that they have to stay invested in the market even if the fund manager sees an imminent crash in his assets. But there is not much he can do about it. Investors will not pay exorbitant fees to keep their capital in cash. As a private investor you can step out into cash with a click of a button any time you wish.

Leverage. Because of their size and regulation, most funds cannot use leverage (borrowing money to invest). But as an independent trader, you can get up to 100:1 leverage for your investments without extra costs. Meaning that with just $1,000 you can control and invest $100,000. With this leverage you can grow your investments very quickly. I advise you to be very careful with leverage: if you don't control your risk and don't have a positive expectancy trading strategy you can lose your entire investments very quickly as leverage multiplies both – returns and risks.

Liquidity. If the fund has to enter or exit the market with a billion-dollar position, this can be very costly and hard to hide from other market participants. Traders will spy on large moves and front-running costs the fund millions in lost potential returns. No such problems exist when you're an independent trader. The sizes you trade do not move the market, which lets you enter and exit the market in a matter of seconds at the market price.

Fees. Funds’ main income is management fees rather than performance fees. When you have billions of dollars under management and can charge a 2% management fee, you can earn a lot of money as a fund ( more than from performance fees). The fund's business model becomes to grow the assets-under-management as quickly as possible while keeping the volatility low. This is safe and easy to do – and remarkably lucrative. Much safer than trying to increase the performance with a risk of losing customers due to increased volatility. That is why funds rather invest their money in their Marketing and PR departments than smarter investment strategies. As far as their performance is concerned they just need to match stock market performance as close as possible.

As you can see there is a big advantage being a small independent investor. If you invest a bit of your time in learning how to invest your money correctly you can do far better than 9% per year; you can outperform the best funds.

If you’re just starting and have never invested in anything I can recommend a brilliant book by Andrew Craig: How to Own the World. This will give you all the investing basics and, more importantly, the confidence to invest your own money.

Then once you’re ready to advance to the next level – Automated trading and Investing – give DARA a call.