DANGERS OF TRADING WITH ROBOTS (READY-MADE)

Following up my post the other day about skills that a Million-dollar trader needs, I wanted to highlight some of the issues discussed about algo trading. Under skill number 5 – Automated Processes – I specifically gave some warnings about relying on ready-made robots. Here’s an expanded view on the issues with relying on automated trading robots that you don’t fully comprehend.

#1 - YOU HAVE NO IDEA WHAT IS GOING ON INSIDE A BLACK BOX

For a trader, not knowing what is going on is the worst possible position to be in. Not understanding why the robot placed a trade is pretty bad – and deceptive! When things are going well it might seem fine. But as soon as your robot hits a bit of a rough patch and enters a drawdown (no system can be traded without a drawdown) you will inevitably start meddling with it. Or worse, stop following the trading strategy at the worst time. Without understanding how the robot trades or the reasons why it placed a certain trade, you will never successfully trade it long-term. There is no chance in hell that a million-dollar trader trades using a black box system he does not understand.

As a side note - there are quant funds that would trade algorithms without fully understanding why algos picked these trades - and it might be OK for a billion-dollar fund with 500 statisticians and mathematicians monitoring and working on the algorithms. But if you’re an independent trader - trading your own money, you don't have the luxury of 500 scientists monitoring your algorithms and telling you that the algo is working fine. You have to know yourself - How, Why and When your robot trades if you’re going to be a successful Algo trader.

#2 - YOU LEARN NOTHING

If you take no part in the decision-making process of a robot’s trading process, you learn nothing. You’re out of the loop. Some traders might say that it’s better if they keep themselves out of the loop in case they start interfering with the strategy (skill number 4 - knowledge in the previous article). This is where your discipline as a trader must come in. If you rather not know anything about the trading processes and want to sit on the sidelines, that means you’re not a trader. You would be far better off just getting a money manager to do the trading for you. As highlighted in reason #6 below, robots are executors – not managers.

#3 - YOU WILL NOT IMPROVE

If you learn nothing you cannot improve. One of the skills necessary for a million dollar trader is self-development. How do you expect to improve your trading and other skills necessary for successful trading if you’re not the one doing the trading?

#4 - YOU WILL NOT GET CHART TIME

A famous Wall Street adage reads “Time in the market beats timing the market.” As traders, we could say the same thing about learning from charts. One of the best ways for beginners to develop their market knowledge and trading skills needed for successful trading is by learning from charts. If you trade with robots automatically, according to algorithms you don’t understand, you get no chart time and won’t learn. At best you will be left with trading records that you don’t understand. This is like playing blackjack without knowing anything about the game rules.

#5 - ROBOTS TRADE SIGNALS NOT A STRATEGY

To understand this disadvantage of trading with ready-made robots, we need to first establish what a strategy is.

Dictionary entry:

A trading strategy is not just a set of trading rules but a long-term plan to achieve an overall goal (with military precision, we might add).

Trading strategy is the war; a trading signal is an individual battle. It’s great to win a battle, but your goal is to win the war.

Trading robots are programmed to trade market signals (individual battles). In the quant talk, we call this ‘alpha’ – a specific edge that exists in the markets. This edge can be a particular pattern or market abnormality that yields (excess) return over time.

But robots can’t trade strategies (the war) as they have no way of knowing what is important to you. Only humans can develop strategies; only humans have goals that they want to achieve.

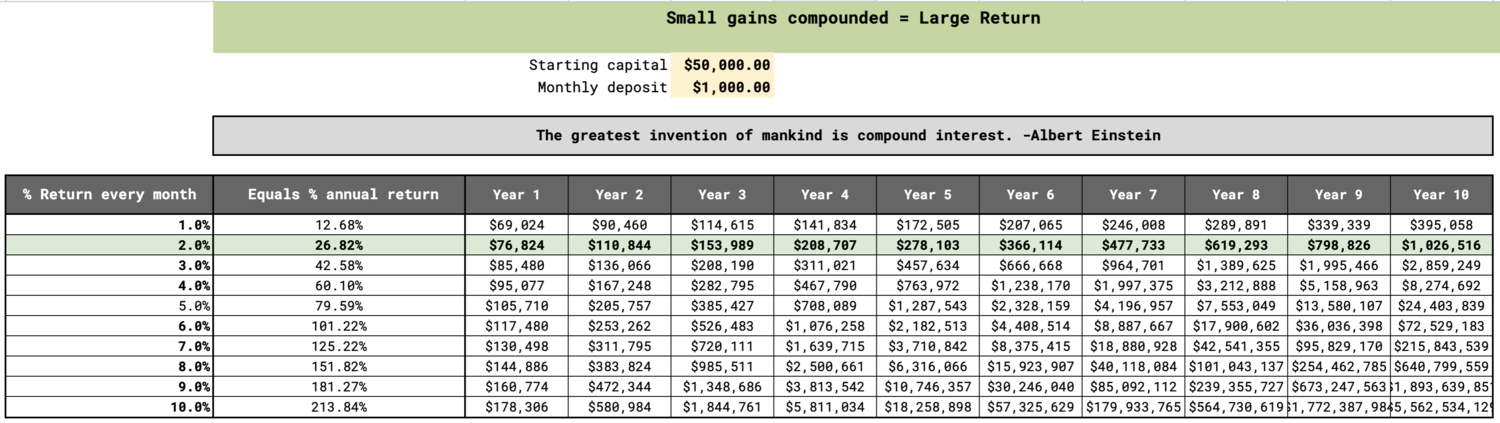

One trader’s strategy can be a plan to extract just 2% profit per month with very low risk over the next 10 years. He starts with $50,000 and will add $1,000 each month to his trading account such that in 10 years he will have $1,000,000 and can quit his day job. 🏖

Math to prove this:

Another trader’s strategy can be to gain 100% annual profit this year with very high risk (risking the whole account) on his $5,000 starting capital with the final goal of winning a trading competition, ultimately earning him a $1,000,000 trading capital.

The point here is that robots don't know your objectives or your long-term plans and strategies. Only you can develop a strategy that fits your circumstances and desires (and risk tolerance, mind you!).

#6 - ROBOTS ARE EXECUTORS NOT MANAGERS

One of the biggest misconceptions with algorithmic trading is that beginner traders confuse the high performance of robo-traders with how this performance was achieved. They hear the word ‘robot’ and immediately think of a superhuman beast that does all the trading for them – one that they don’t need to supervise, but just deliver checks (or Bitcoin) every Friday. This is exactly the mirage that most robot-selling sites will tell you. Nothing could be further from the truth.

Robots are fantastic tools for pattern recognition, for finding Alphas, for detecting market abnormalities/correlations, and testing strategies. They’re great for market analysis, for trade execution, for risk control and trade management and so on. But without an intelligent human manager who sets objectives for the robot to follow, and who manages his robots DAILY, robots will trade aimlessly. In the hands of inexperienced traders, this can be very dangerous. To be a successful robot trader you need to develop all the 8 skills of a million-dollar trader.

#7 - DEVELOP A “ME VS MACHINE” MENTALITY

A lot of experienced discretionary traders who venture into algo trading develop a ME vs MACHINE mentality. They hear how much better robo-traders are doing and say: “OK, if you’re so smart – go and trade for me! But I don't want to know anything about this. Let’s see if you can do better than me.”

The problem with this mentality is that it is destined to fail. As discussed in danger number 6, robots are executors not managers. They require intelligent humans to manage them. In fact, experienced discretionary traders are one of the best-placed traders to take advantage of algorithms that support their trading.

So, that’s it for robots and algorithmic trading? It’s all a waste of time?

Absolutely not. The opposite, in fact. Robots wielded correctly by an expert pair of trader hands can be a perfect match that will dominate markets for decades.

HUMAN + MACHINE IS THE SWEET SPOT.

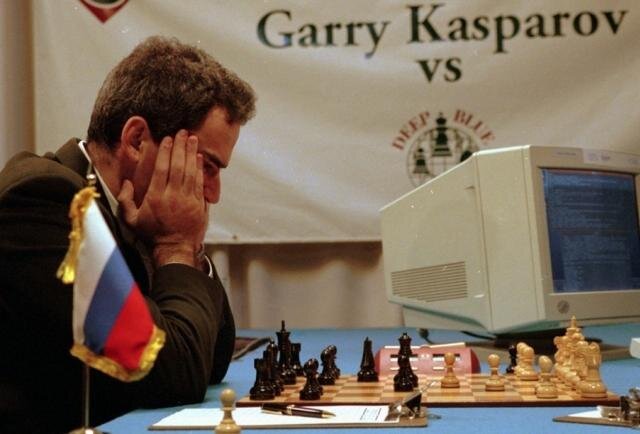

No human is better at chess than a computer (sorry Garry 😭)

But no computer is better at chess than a human supported by a computer. Garry Kasparov proved this with his Advanced chess program where human players played chess in teams together with a computer against other human and computer teams.

The trading world works the same way: human traders are at a disadvantage when trading against robots, but the best results are achieved when combining humans and machines.

Robots and algo trading software are great – but you’ve got to use them in the right ways.