DRIVERLESS METRO AND TRADERLESS INVESTING.

I was in Paris last weekend with my daughter to watch the Paris Masters. My highlight was the epic final between Novak Djokovic and 19-year-old winner Holger Rune. My daughter's highlight, on the other hand, was the newly installed driverless Paris metro trains. A 3-hour tennis battle can get a bit boring for an eight-year-old.

The sleek train where you can sit right at the front of it, where the conductor's cabin used to be, and pretend to be a “driver” as it speeds through the dark underground tunnels and picks up Parisians is a very “cool” idea for kids. The train’s front cabin even has fake control buttons to play with.

I must say I was pleasantly surprised as well. The service was effortless, smooth, and felt “normal”. It did not bother me one bit that my daughter was pretending to drive the train that was operated by AI speeding through dark tunnels at speeds of up to 80 km/h.

Maybe the future of AI is not so scary after all.

Parisians seem to agree. All new Paris metro lines will be fully automatic and existing lines where economically viable will be upgraded to automatic driverless trains over the next few years. The main benefits being the operational efficiency, reduced delays, lower energy consumption by up to 15%, and the ability to adapt the train service to meet demand in real-time. These benefits will also allow the operators to deploy more human staff to be on hand at the stations. That sounds like a great plan and a win-win for everyone - commuters and the operator.

THE FUTURE OF TRADING IS AI.

This got me thinking - How long before we will see AI replace human traders and the financial markets are just AI vs AI with no chance for human traders to compete and win?

AI in financial markets is nothing new and it has been used in the markets ever since electronic trading came into existence in the late 1990s. However, the complete shift to AI trading, where humans become obsolete and can not compete with AI, is still some decades away and might not even happen in my lifetime. To understand why it is a very different ball game to speculate in the financial markets compared to driving a metro train we just need to look at the operational systems in place at the Paris metro. For starters, the metro is a completely closed environment (silo) - exact track layouts, completely closed access to the track (they installed platform screen doors at all the stations), and thousands of sensors and cameras everywhere so the train and the control centre knows exactly where it is and the location of all the other trains. Everything is controlled from the “brain” - control centre where 400 human staff operate, monitor and supervise the systems. This is what’s called a closed system with all the variables known. Everything is predictable and there are no surprises. It is easy for AI to operate and provide efficiency in a closed system like this. This is called a narrow AI - It just follows the rules set by the human managers with humans supervising it. Looking at this system, it is no wonder that driverless cars that can drive on real open roads with many unknowns and dangers are still many years away. Humans have spent more than 60 years on AI development and the best application of AI is still only in closed systems with strict rules.

Looking at the financial markets this is a completely open system with absolutely no rules. At least on the open roads cars and living organisms have to obey the gravity and inertia laws. In the financial markets, anything and everything can happen at any time. There are no rules on how much the market can go up or down, how fast or slow it can move or just stay stagnated. Anyone can buy or sell at any time. Billion-dollar companies can get liquidated and become insolvent in a matter of hours. At any moment any new market participant can enter the market with an unlimited amount of capital and move the market. There is insider trading, there is order front running, and there is HFT. There is twitter. And to top it all off, the historical data that all the other industries like medicine and transportation rely on in developing AI systems gives no reliable indication of the future performance in the financial industry.

There is no general (wide) AI right now that can take all this information into account and become so good in the financial markets that no humans can compete with it. And judging by the progress of AI in other fields it will be another 50 years at least before we could see a real danger to human traders becoming obsolete.

NARROW AI IN A COMPLEX SYSTEM

However, it's not all bad news for Algo traders because you can create closed systems (silos) in an open environment for narrow AI to operate it. You can develop a narrow AI system to look for specific patterns or conditions on which to react. This type of narrow AI works very well in the financial markets and is ready right now even as a no-code system. (DARA is this type of system). This system is very similar to the Paris metro system in that it is very efficient at doing one thing very well. And it does so 24/7, yet with narrow AI, human managers still need to control and supervise it.

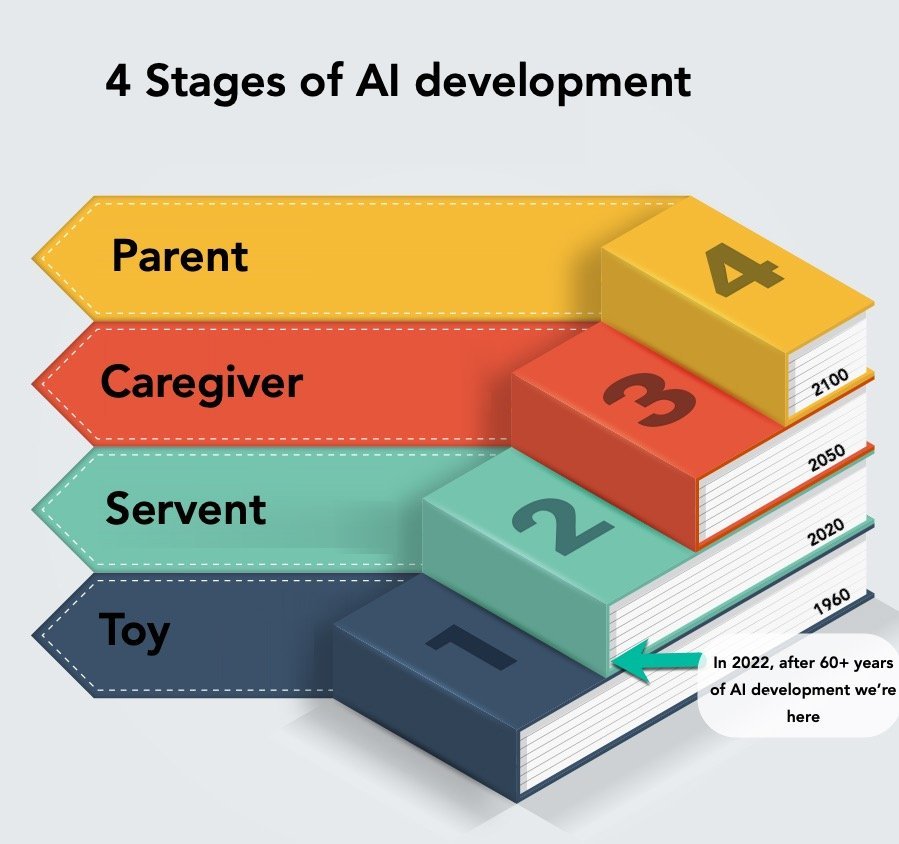

Dr Murray Campbell, who was part of IBM’s deep blue team that beat the chess grandmaster Gary Kasparov in the iconic Man Vs machine matchup in 1997, says that there are four phases in AI development: Toy, Servant, Caregiver and Parent.

The first phase is when computers are a toy – too weak to help humans.

The second phase is when computers are servants - It does certain things quite well but still is not as good as people and so humans remain in charge.

The third phase caregiver - this is when the computer gets very good but with gaps in knowledge where humans can influence it and make it better.

The fourth phase is a parent - this is when it becomes very hard for humans to influence computers to make it any better.

Chess is in the fourth phase.

Paris metro and the financial market trading are in the second phase - computers do certain things quite well but still are not as good as people and so humans remain in charge. This phase is the most beneficial for humans since it allows humans to thrive and work on ideas and exploration. While delegating all the laborious and tedious tasks such as order execution, risk management and market pattern scanning to computers.